<meta name='impact-site-verification' value='undefined'>

StatesCard:Seamlessly Unlock US-Based Services Globally-2024

Table Of Content

Table of Contents

Introduction

The digital age has revolutionized how we access entertainment, shop, and conduct business. Yet, geo-restrictions often limit these experiences, especially for international users trying to access US-based services. StatesCard is a solution designed to bridge this gap. By providing a virtual prepaid Visa card with a US billing address, StatesCard allows users worldwide to enjoy US-exclusive online services and products. This article delves into the features, benefits, and practical applications of StatesCard, highlighting its significance in the global digital economy.

What is a StatesCard?

StatesCard is a virtual card service that enables users to access US-based services from anywhere globally. It facilitates seamless access to American platforms such as streaming services, online shopping sites, and financial services that may otherwise be restricted by geographical location. Users can top up the card, which functions like a prepaid virtual card, to make purchases and subscriptions on these platforms, thereby bypassing regional restrictions and enjoying US-exclusive content and services.

Understanding StatesCard

Key Features of StatesCard

- Virtual US Card with a US Billing Address:

- The core feature of this visual Card is its virtual Visa card, paired with an American billing address. This feature is pivotal for users aiming to overcome the barriers posed by geo-restrictions.

- Access to US Digital Services:

- StatesCard opens the door to a plethora of US digital services such as HBO, Hulu, Paramount+, and ESPN+. This is especially beneficial for users in regions where these services are otherwise inaccessible.

- US App Stores and Online Shopping:

- Users can download and pay for apps from US-based app stores like the Apple App Store and Google Play Store. Additionally, it simplifies online shopping from US retailers, thanks to the included US billing address.

- Ease of Use:

- The process of obtaining and using a visual card is straightforward. Users can sign up, load funds onto the card, and start using it almost immediately. There are no credit checks or complex steps involved.

- Funding and Spending:

- The card can be topped up instantly using various methods such as credit/debit cards, PayPal, and Apple/Google Pay. This makes it easy for users to manage their finances and track spending.

Benefits of Using StatesCard

- Overcoming Geo-Restrictions:

- One of the most significant benefits of the Card is its ability to bypass geo-restrictions. Many US-based services and retailers only accept payments from US-issued cards. This Card provides a simple solution to this problem by offering a US billing address, making it appear as though the user is making a domestic transaction.

- Enhanced Privacy and Security:

- Using a virtual prepaid card adds an extra layer of security. Users do not have to expose their primary credit or debit card details online, reducing the risk of fraud. Additionally, the privacy policies of this card ensure that user data is protected.

- Convenience:

- This Card is designed to be user-friendly. The registration process is quick, and users can start using their virtual card almost immediately after loading funds. This card can be used anywhere Visa is accepted, providing flexibility and convenience.

- Global Accessibility:

- This card is available to users worldwide. Whether you are in Europe, Asia, Africa, or any other region, you can sign up for StatesCard and gain access to US-based services and products.

- Cost-Effective Solution:

- Compared to other methods of accessing US services, such as using intermediaries or purchasing gift cards, it is a cost-effective solution. The transparent fee structure ensures users know what they are paying for, without hidden costs.

How to Get Started with States Card

- Sign Up:

- The first step is to sign up for an account on the StatesCard website. The process is simple and requires basic information to create an account.

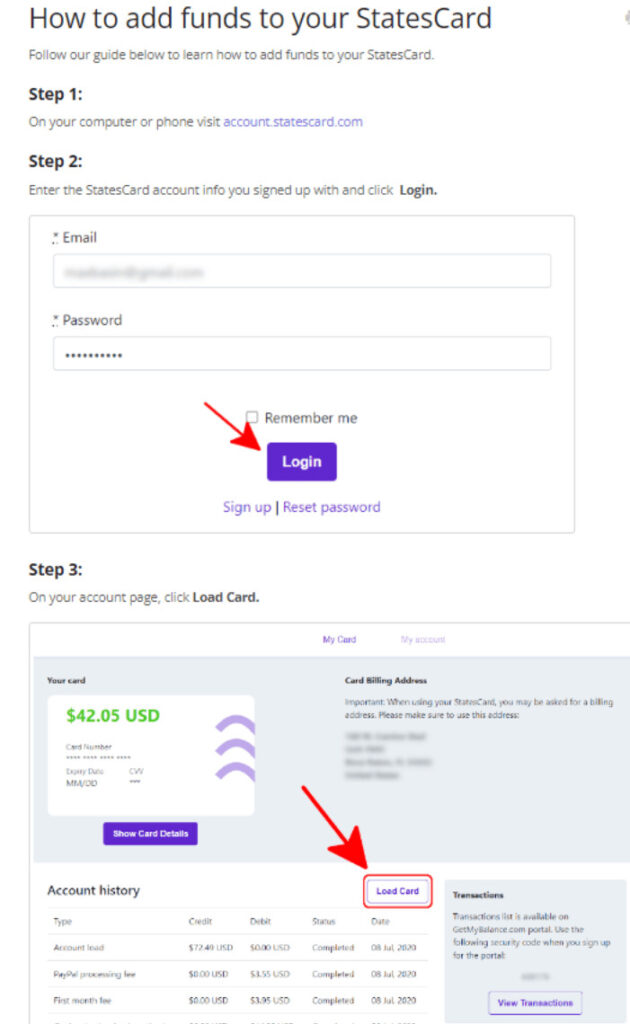

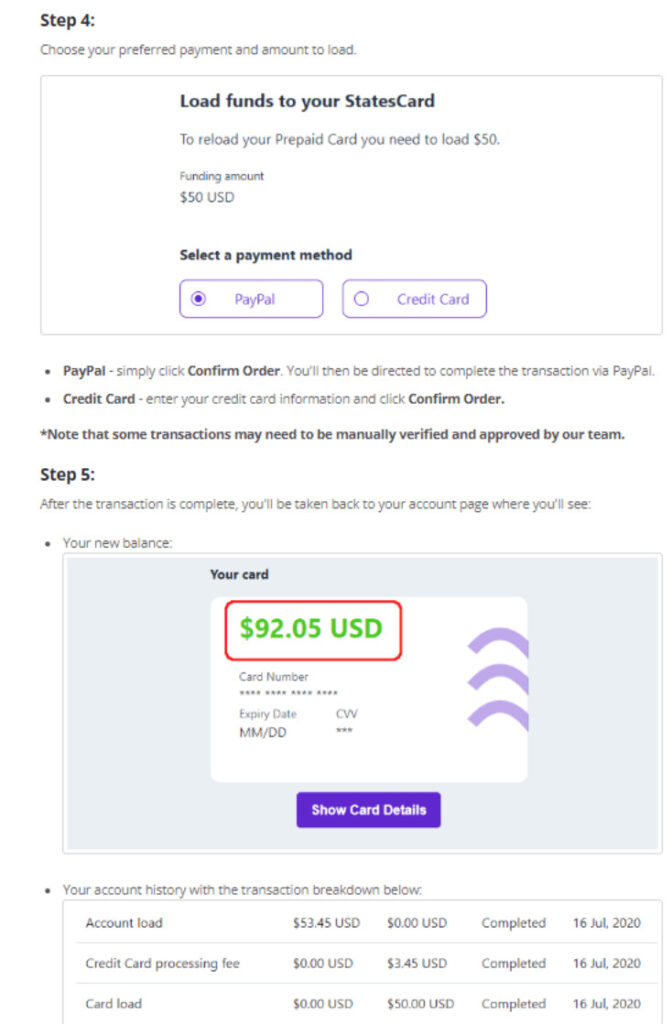

- Load Funds:

- After signing up, users need to load funds onto their virtual card. It offers multiple funding options, including credit/debit cards, PayPal, and Apple/Google Pay.

- Start Using:

- Once this card is funded, it is ready to use. Users can enter the card details, including the US billing address provided, to make purchases and subscribe to services.

StatesCard Pricing

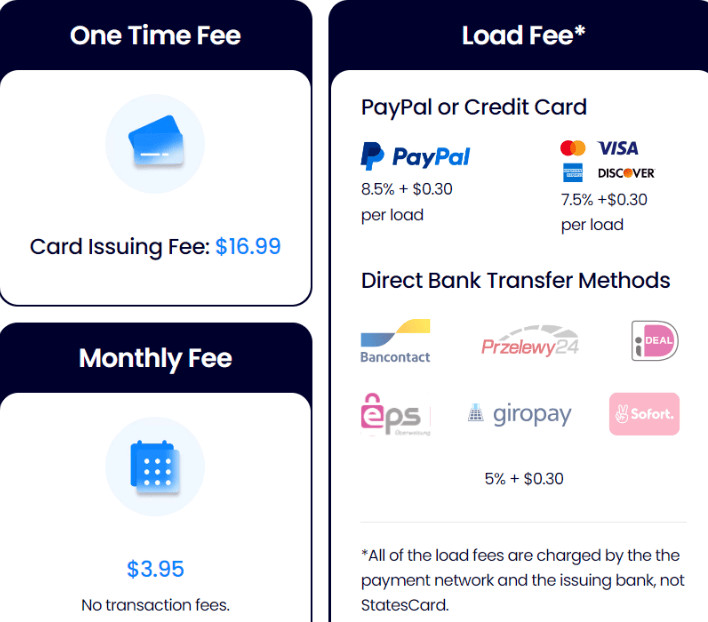

It offers a straightforward pricing structure for its virtual US card, which is particularly useful for non-US residents needing a US-based payment method. Here’s the breakdown of the costs:

- One-Time Card Issuing Fee: $16.99. This fee is collected when you first load funds onto your card .

- Monthly Fee: $3.95. This is charged to your account every month.

- Loading Fees:

- Credit Card: 7.5% + $0.30 per load.

- PayPal: 8.5% + $0.30 per load.

- Direct Bank Transfer Methods (e.g., Bancontact, EPS, Giropay, iDEAL, Przelewy24, Sofort): Generally 5% + $0.30 per load, except iDEAL which is 5% + $0.80, and Sofort which is 3.4% + $0.30.

These fees cover the use of this visual card for accessing US-based services like streaming platforms, app stores, and online shopping that require a US payment method and billing address. There are no additional transaction fees beyond the ones mentioned above, making it a predictable option for managing expenses .

For more details and to get started, you can visit the StatesCard website directly.

How to top up StatesCard?

Here is the step-by-step process to top up or add funds to your states card.

Practical Applications of StatesCard

- Streaming Services:

- Many popular streaming services like Netflix, Hulu, HBO Max, and Disney+ have extensive libraries available only in the US. StatesCard allows international users to subscribe to these services, unlocking a vast array of content.

- Online Shopping:

- US-based retailers such as Amazon, Walmart, and Best Buy often have exclusive deals and products. It enables users to shop from these retailers without facing payment issues due to geo-restrictions.

- App Stores:

- Some apps and digital content are only available on US versions of the Apple App Store and Google Play Store. With this visual card, users can access and purchase these apps seamlessly.

- Gaming:

- Gamers can use this visual card to buy games, in-game content, and subscriptions on platforms like Steam, PlayStation Network, and Xbox Live, which sometimes offer US-exclusive content and deals.

- Subscription Services:

- Services such as Amazon Prime, Audible, and various magazine subscriptions often provide US-only promotions and benefits. This Card allows users to take advantage of these offers.

Security and Privacy Considerations

It takes user security and privacy seriously. Here are some of the measures in place to ensure safe transactions:

- Virtual Card Security:

- The virtual nature of the card means there is no physical card to lose or steal. This reduces the risk of unauthorized use.

- Data Protection:

- It adheres to strict data protection policies, ensuring that user information is safeguarded against unauthorized access.

- Transaction Monitoring:

- Transactions made with this visual Card are monitored for suspicious activity, providing an additional layer of security.

Is StatesCard Legit?

Customer Support: Customer support is available through a contact form on their website, with responses typically within a few hours during the day. While there is no live chat, the website offers a comprehensive Knowledge Base with detailed articles covering most user queries.

Legitimacy and Security: According to Scam Detector, StatesCard is deemed a likely trustworthy website. The platform uses HTTPS for secure connections and does not appear on any major blacklists, which are good indicators of its legitimacy.

User Feedback: User reviews and expert analyses generally describe StatesCard as a reliable solution for accessing US-based online services from abroad. However, there are some limitations, such as the inability to withdraw funds or use the card for cryptocurrency transactions.

Common Challenges and Solutions

While StatesCard offers numerous benefits, users might encounter some challenges. Here are common issues and their solutions:

- VPN Requirement:

- To ensure transactions appear as though they are coming from the US, StatesCard recommends using a VPN. This can be a minor inconvenience but is necessary to avoid geo-location mismatches.

- Merchant Acceptance:

- Not all merchants may accept prepaid cards. It’s advisable to check with specific merchants before making purchases to avoid declined transactions.

- Funding Limitations:

- While this visual card supports various funding methods, users should be aware of potential fees associated with different funding options.

Customer Support and Resources

This visual card offers robust customer support to assist users with any issues. Resources available include:

- FAQs:

- The StatesCard website features a comprehensive FAQ section that addresses common questions and concerns.

- Customer Support:

- Users can contact customer support for personalized assistance with their accounts and transactions.

- Does StatesCard work with Peacock?

- If you check your StatesCard account, you’ll notice it has been topped up with funds and is ready to be used for subscribing to Peacock TV. Your account also displays your U.S. billing address, which you will need during the Peacock TV sign-up process.

- What is the load limit for StatesCard?

- $100 per month when loading via credit card or PayPal. $500 per month when loading via a direct banking payment method or any asynchronous payment method (For example ( EPS, Giropay, SEPA, etc.)

- How much does StatesCard charge?

- The monthly fee of $3.95 is charged to your account. We try to collect any due monthly fees either when you load more funds or directly from your StatesCard balance.

- For more knowledgebase please contact support@statescard.com

User Testimonials

Many users have shared positive experiences with StatesCards. Testimonials highlight the key benefits of the ease of use, reliability, and ability to access US-exclusive services. Here are a few examples:

- Entertainment Access:

- “Thanks to StatesCard, I can now enjoy my favorite US shows on Hulu and HBO Max without any hassle. It’s been a game-changer for my entertainment needs.” – Sarah, UK.

- Shopping Convenience:

- “I’ve always wanted to shop from US stores but faced payment issues. StatesCard solved this problem for me, and now I can take advantage of US deals and products.” – Raj, India.

- App Store Access:

- “Getting access to US-only apps on the Apple App Store was a breeze with StatesCard. Highly recommend it to anyone facing geo-restriction issues.” – Maria, Brazil.

Conclusion

StatesCard is an innovative solution that addresses the challenges posed by geo-restrictions on US-based services and products. Its virtual prepaid Visa card, combined with a US billing address, provides users worldwide with unprecedented access to US digital services, shopping, and more. With its ease of use, security features, and cost-effectiveness, it is an invaluable tool for navigating the global digital landscape.

For anyone looking to unlock the full potential of US-based services and enjoy a seamless online experience, StatesCard is a highly recommended option. To get started, visit StatesCard and sign up today.